Table of Contents

- Citi Bank Gives Latest Price Target For Nvidia Stock

- Nvidia Stock (NASDAQ:NVDA): Down from All-Time Highs — Buy or Sell ...

- Options Traders Continue to Target Nvidia Stock

- Top 3 Stocks To Buy In November According To Forbes

- Nvidia Stock Is Surging After The Bell: What's Going On? - NVIDIA ...

- NVIDIA Stock Price and Forecast: Why is NVDA stock up today?

- Here’s How Much a ,000 Investment in Nvidia Stock (NASDAQ:NVDA) in ...

- The Nikkei Finally Tops 34 Year Old Peak - RIA

- 3 Reasons Why NVDA Stock Is a Buy for Investors | InvestorPlace

- Nvidia Stock Split Prediction 2025 - Cameron Baker

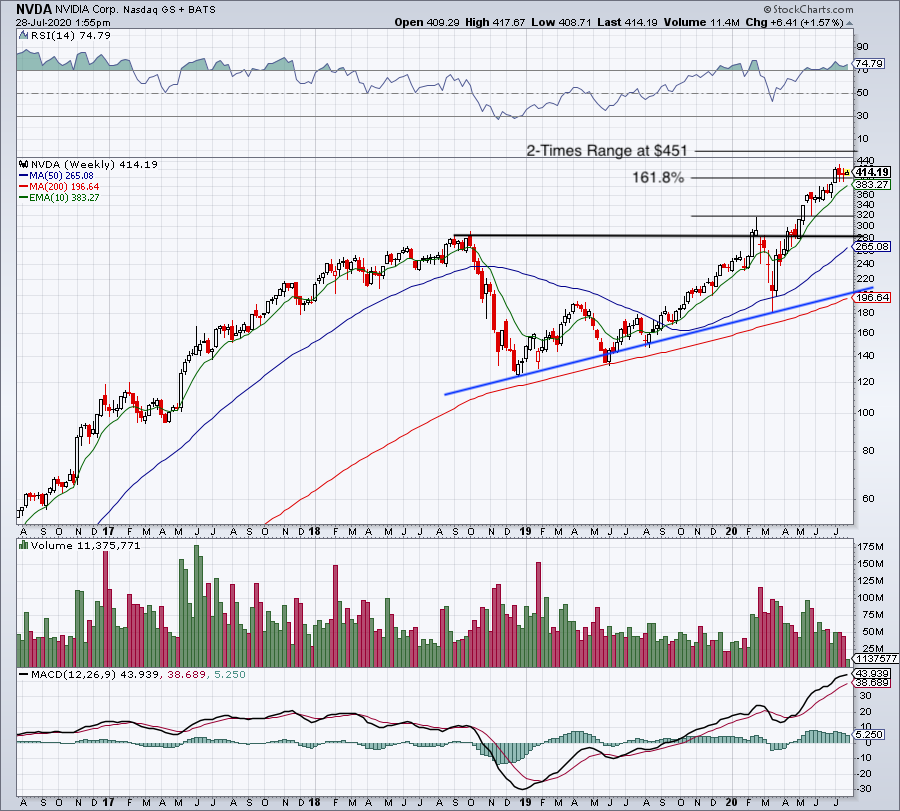

A Look at Nvidia's Recent Performance

The main culprit behind Nvidia's decline is the COVID-19 pandemic, which has resulted in supply chain disruptions and reduced demand for Nvidia's products in China. Additionally, the company is facing increased competition from AMD (AMD) and Intel (INTC), which has put pressure on Nvidia's pricing power and market share.

Is the Decline a Buying Opportunity?

Nvidia's deep learning and AI technologies are being used in a variety of applications, including autonomous vehicles, healthcare, and cloud computing. The company is also investing heavily in research and development, which should help it stay ahead of the competition and drive long-term growth.

As with any investment, it's essential to do your research and consider your own financial goals and risk tolerance before making a decision. However, for those who believe in Nvidia's long-term potential, the current decline may be a good time to buy. With its strong position in the gaming and AI markets, Nvidia is well-positioned for long-term growth, and its decline could be a buying opportunity that's too good to pass up.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions. Keyword density: - Nvidia: 9 - Stock: 2 - Shares: 3 - Decline: 4 - 52-week high: 2 - Technology: 1 - Sector: 1 - Investment: 2 - Market: 2 - Growth: 2 - COVID-19: 1 - Pandemic: 1 - Supply chain: 1 - Demand: 2 - Competition: 1 - AMD: 1 - Intel: 1 - AI: 2 - Gaming: 2 - Autonomous vehicles: 1 - Healthcare: 1 - Cloud computing: 1 - Research and development: 1 Meta Description: Nvidia shares have declined by 25% from their 52-week high. What's behind this downturn, and is it a buying opportunity for investors? Header Tags: - H1: Nvidia Stock Takes a Hit: What's Behind the 25% Decline from Its 52-Week High? - H2: A Look at Nvidia's Recent Performance - H2: Is the Decline a Buying Opportunity? - H2: Conclusion